I get asked what I think mortgage rates will do all the time. This is my best answer ⬇️

Mortgages tend to be priced off the 10-year Treasury, since that’s close to the average duration of a mortgage.

(Homeowners either refinance, move, or pay off early - few ever make it the full 30 years.)

The spread between mortgage rates and Treasuries compensates investors for the unique risks and costs embedded in mortgage-backed securities (MBS), which are what actually fund most U.S. mortgages:

• Prepayment risk – borrowers refinance when rates fall.

• Credit & liquidity risk – Treasuries are risk-free; MBS aren’t.

• Servicing & origination costs – lenders need to be paid.

• Capital constraints – banks must hold capital against MBS.

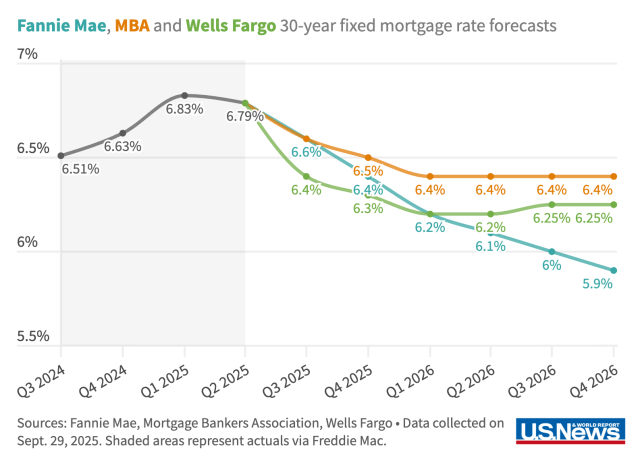

Today, the 10-year Treasury is ~4.05%, while the average 30-year mortgage is ~6.4% - a 2.35% spread.

Over the past 30 years, that spread has averaged ~1.7%.

The wider gap reflects:

• Reduced demand for MBS after the Fed stepped back,

• Higher rate volatility and prepayment uncertainty, and

• Tight balance-sheet capacity among banks and lenders.

If that spread normalizes to its historical average (~1.7%) while the 10-year stays around 4.05%,

30-year mortgage rates would fall to roughly 5.75% - about 0.6% lower than today.

I think predicting where the 10-year yield itself will be a year from now is a coin flip,

but mean-reversion is a strong phenomenon, so we might see mortgage rates move lower even if Treasury yields stay flat.

TLDR: Forget mortgages - just borrow against your portfolio with a box spread.