This estate planning move makes every other strategy look basic.

It’s called the Installment Sale to an Intentionally Defective Grantor Trust (IDGT) - and despite talk of it being eliminated, it’s still alive and well.

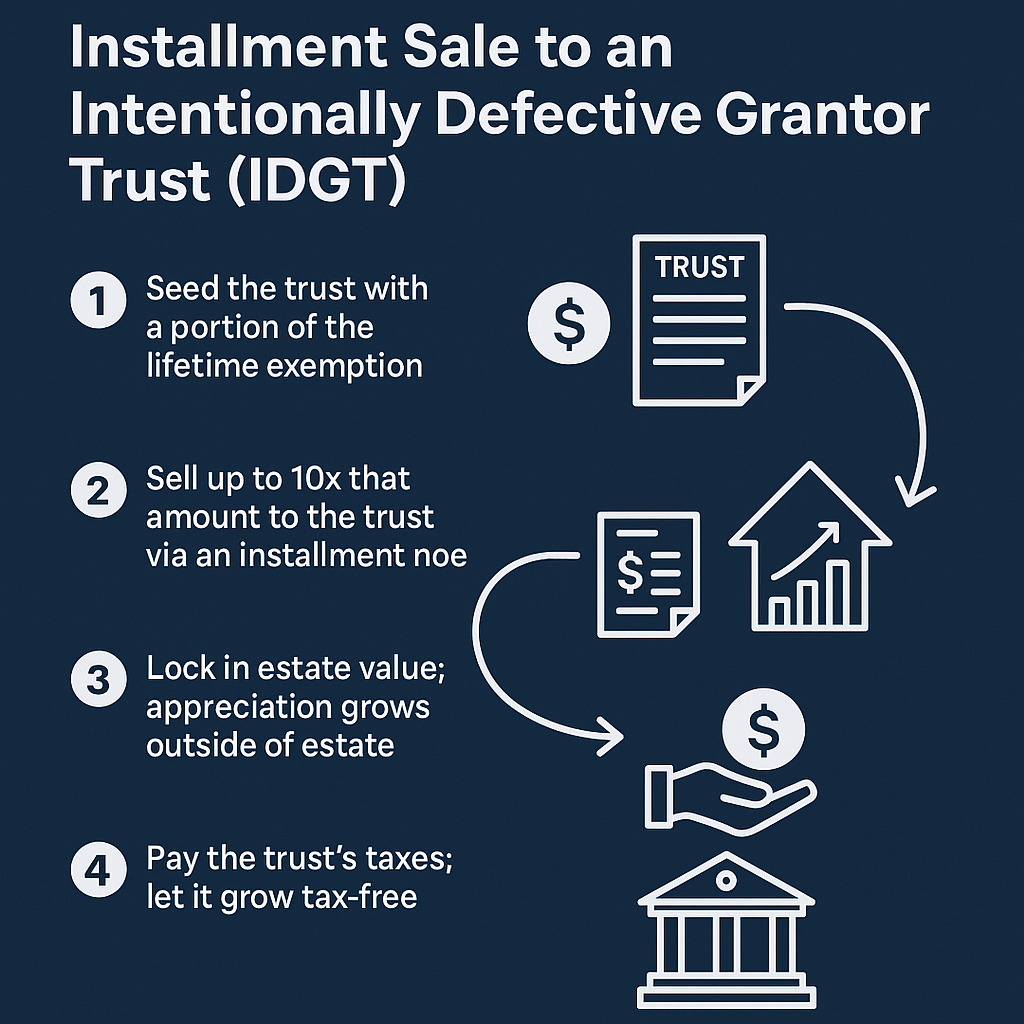

Quick breakdown:

- You seed a trust with a chunk of your lifetime exemption (say $30M).

- You then sell up to 10x that amount ($300M) to the trust using an installment note.

- The note “locks in” your estate’s value - all future growth escapes estate tax.

- Because it’s a grantor trust, you cover its taxes personally, quietly reducing your estate even more.

Downside? No step-up in basis at death.

Fix? Swap the appreciated assets back into your estate before you die (often using borrowed cash). The assets qualify for step-up, but your estate value doesn’t actually rise.

Throw in valuation discounts on business interests gifted in minority slices - and you’ve got one of the most tax-efficient structures ever designed.

Truly next-level stuff.