FINALLY got the K-1s from someone’s old wealth management firm… what a nightmare.

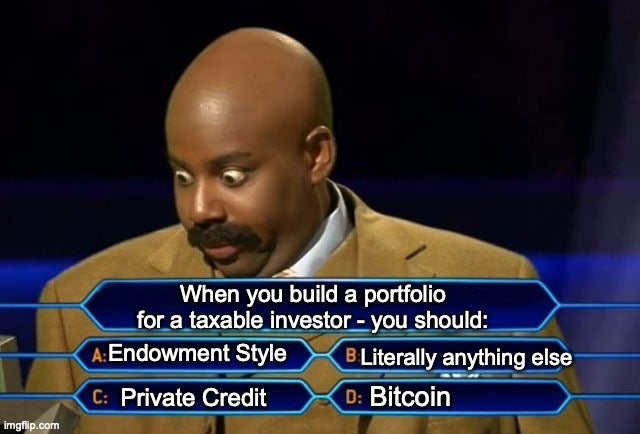

These “ultra sophisticated, endowment-model” firms love to talk about innovation and complexity, but let me tell you what the actual client experience is:

- Extend your taxes and wait (and wait) for K-1s

- K-1s come from horrendously tax-inefficient investments

- Then you have to withdraw from your portfolio to write a six-figure check to the IRS

This is ridiculous.

When I build QFS portfolios, I take all of this into consideration:

✅ We don’t create tax bills - we cut them

✅ We don’t extend tax filings - every K-1 we deliver comes before April 15th

✅ The client experience is 100% better and the after-tax returns should be higher

People tell me, “Wow Samuel, you’ve found a really good niche for yourself.”

My response: What niche? Everyone pays taxes. Every advisor should be doing this - it makes no sense that clients just go along with the old model.