Sometimes the smartest tax move… is to create income. 🤯

That sounds backwards, right?

Most people focus on deferring income and avoiding capital gains. But there are years when intentionally triggering income or gains can lower your lifetime tax bill.

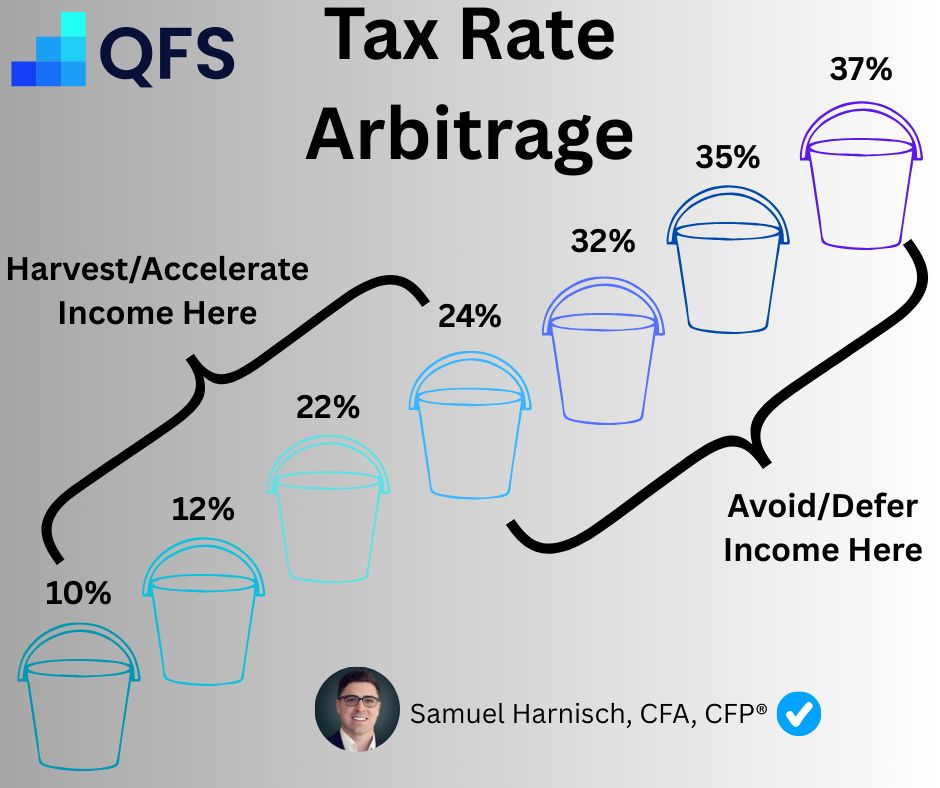

👉 It’s called Tax Rate Arbitrage.

When you know your future tax brackets will be higher, harvesting income while you’re in lower brackets can save you hundreds of thousands over time.

Here’s when it makes sense:

• You take a year off work

• You sell a business and have low earned income the following year

• You’re sitting on a mountain of real estate depreciation or paper losses

• You’re temporarily in a lower tax bracket due to life changes

In those years, it can make sense to:

• Execute Roth conversions while you’re in a lower bracket

• Realize capital gains to raise your cost basis with little or no tax

• Pull forward income that would otherwise be taxed at a higher rate later

I also have advanced strategies that can help you shift income into lower brackets, even in your highest earning years - including:

• Long/Short stock accounts that help offset capital gains

• Tax-aware hedge funds that can offset income (even W-2)

• Retirement plans that let business owners defer $300k+ per year

If you’re looking for ways to flatten your tax curve and keep more of what you earn - let’s connect.