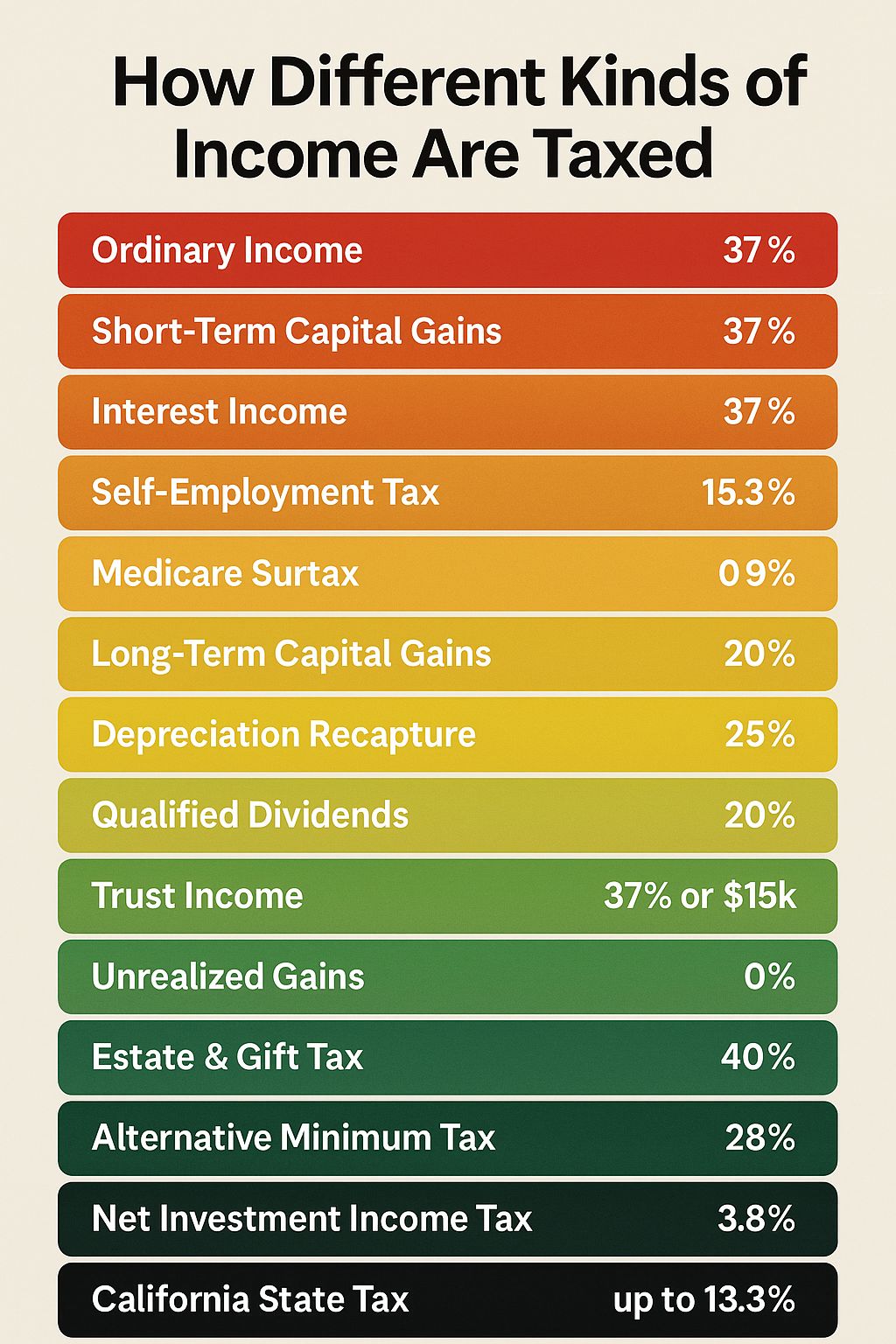

There isn’t just one tax code—there are dozens.

And if you’re a high earner or business owner, you’re exposed to the worst of them.

Ordinary income tax? That’s just the start.

You might also face:

• Depreciation recapture – a stealth 25%+ tax when you sell real estate

• Alternative Minimum Tax (AMT) – a parallel system that ignores most deductions

• Estate tax – 40% of your wealth gone without proper planning

• Trust income tax – 37% federal on just $15,000 of income

• Self-employment tax – 15.3% stacked on top of income tax

• California state tax – up to 13.3% on wages, gains, and dividends

Your portfolio takes two steps forward—and one big step back—thanks to taxes.

With the right strategy, it doesn’t have to be that way.

💡 Here’s how we help clients tilt the game back in their favor:

• Use tax-aware hedge funds to generate ordinary losses against W-2 income

• Execute cost seg studies to offset years of real estate income

• Build estate plans that reduce or eliminate gift and death taxes

• Harvest losses even in rising markets to reduce capital gains

• Optimize entity structures to lower self-employment and payroll taxes

You don’t have to accept taxes as a given.

With the right playbook, you can take back control.