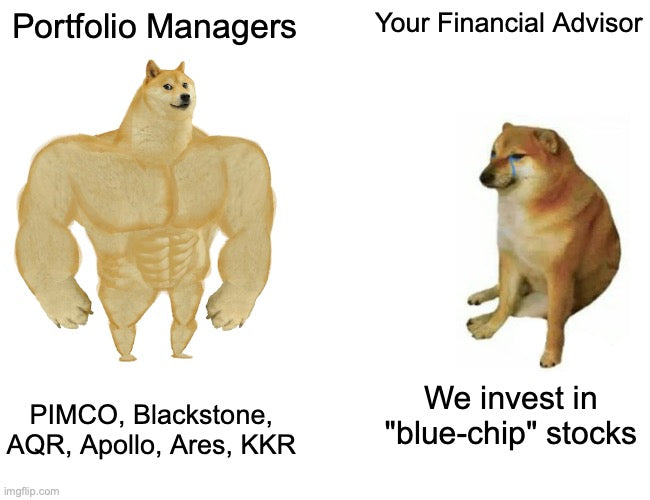

I always laugh at financial advisors who make this mistake

There’s a big difference between a financial advisor and a portfolio manager - and it matters.

I worked at PIMCO, I know what a portfolio manager is - and it’s NOT your financial advisor.

Portfolio managers:

- Decide whether corporate credit or securitized credit is more attractive.

- Assess how EM debt looks given the geopolitical backdrop.

- Debate agency vs. non-agency MBS, CMBS, CLOs, and a hundred other nuances.

That’s their world - and they’re way better at it.

They’ve got the teams, the tech, and the time.

Hedge funds, real estate, private equity, infrastructure, private credit, etc. all of the firms I’ve partnered with are WAY better than me at sourcing/underwriting these investments.

Here’s where a good financial advisor actually adds value 👇

- Design the optimal allocation across asset classes based on goals and risk tolerance

- Identify tax pain points and build portfolios to reduce income, gains, or estate taxes

- Build the financial plan - when to retire, how much to spend, what to convert

- Educate and involve family members to prepare the next generation

- Solidify family values through trusts, charitable funds, and legacy planning

That’s the difference between trying to beat markets…

and building a plan that helps families protect, grow, and pass on their wealth - tax-efficiently.