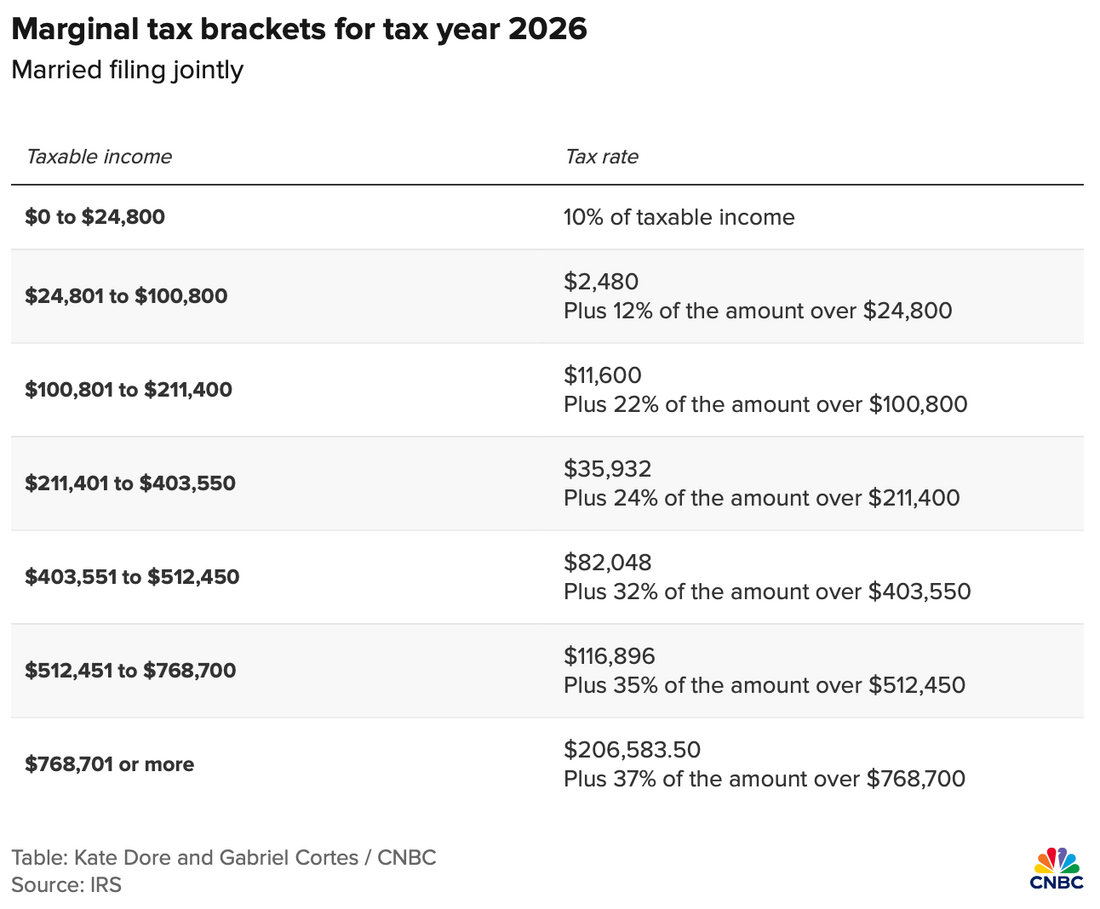

All figures below are for married filing jointly.

Income Tax Brackets

Brackets have been inflation-adjusted upward. The top bracket now starts at $768,700.

Standard Deduction

Increased to $32,200.

Bonus Deduction for Seniors

A new $6,000 deduction is available for taxpayers age 65 and older, phasing out between $150,000 and $250,000 of income.

Alternative Minimum Tax (AMT)

Exemption: $140,200

Phaseout begins at $1,000,000

Estate and Gift Tax

The federal estate exclusion increases to $15,000,000 per person.

401(k) Catch-Up Contributions

Catch-ups can remain pre-tax through 2026.

Starting in 2027, if your FICA wages exceed approximately $145,000 (indexed), catch-ups must be Roth-only.

Long-Term Capital Gains

The 0% tax rate applies to taxable income up to $98,900.

Happy tax planning!